A few days ago, Medtronic has made a major breakthrough in the field of surgical robotics. The company has obtained the CE certification of the Hugo Robotic Assisted Surgery (RAS) system.

Now, the company’s Canadian subsidiary has obtained a license from Health Canada’s Medtronic Hugo surgical robotic system for urology and gynecological laparoscopic surgery, which account for half of all robotic surgery markets today.

In the second quarter 2022 earnings conference call held by Medtronic in November, CEO Geoff Martha revealed that the company has encountered some supply chain issues and some initial manufacturing issues. The limited release of the robot platform Stage, this will mean that Hugo's revenue this fiscal year will be lower than the target. Martha said the company is focusing on solving these problems and ensuring that the initial surgeon’s experience with the technology is positive.

It was learned from Tuesday’s press release that if the same manufacturing and supply issues will affect the commercially launched Hugo surgical robot system in Canada. However, Martha emphasized on the earnings call that these issues mean that the broader business launch is "unplanned...not off track."

01 The "fire of war" with Da Vinci escalated

“This license brings new opportunities for Canadian healthcare. By addressing the historical cost and utilization barriers that have hindered the adoption of robotic surgery for 20 years, it will bring the benefits of robotic-assisted surgery to more patients.” Megan Rosen garten, President of Surgical Robotics Business Said that the business is part of Medtronic's surgical portfolio, "We are beginning to see what the Hugo RAS system can do in the hands of clinicians in Latin America and the Asia-Pacific region, and we are very happy to see the possibilities it creates in Canada."

As early as more than a month ago, the global medical equipment giant Medtronic announced that its Hugo™ Robotic Assisted Surgery (RAS) system has received CE approval. It is understood that many hospitals in Europe will be the first to install the Hugo™ RAS system and extend the benefits of robot-assisted surgery to patients.

The system is also sold in Europe for urology and gynecological surgery, which accounts for all general robotics markets. CE approval follows the important milestones of the global release of the Hugo RAS system, including the first urological and gynecological surgery performed in Latin America and India. .

Although surgical robots can provide patients with the benefits of a series of minimally invasive procedures such as fewer complications, shorter hospital stays, and faster return to normal activities, only about 3% of minimally invasive procedures are performed by robots globally. ongoing. According to previous data, the penetration rate of surgical robots in Europe is still very low. In Western Europe, only about 2% of operations are performed by robots, while most (about 65%) are open surgery, and the rest are traditional minimally invasive surgery.

By 2000, the first Da Vinci surgical robot was approved. It has been monopolizing the market for 21 years, and no one has been out there so far. It is regarded as a "myth" in the medical device industry. The Da Vinci surgical robot represents the highest level of surgical robots today. It has three key core technologies: Endo Wrist, a freely movable arm and wrist, 3D high-definition imaging technology, and the human-computer interaction design of the main console. It has been extended to thoracic surgery. , General Surgery, Urology, Gynecology, Cardiovascular Surgery, etc.

In terms of selling price, Da Vinci robot is about 3.5 million U.S. dollars, and the annual fee for machine maintenance and other services is about 80,000 to 190,000 U.S. dollars. High-value consumables need to be replaced every 10 times, and the price is 700-3500 U.S. dollars. In between, the price is quite "ungrounded."

The Hugo RAS system is designed to solve the historical cost and usage barriers that have hindered the adoption of robotic surgery for two decades. In September 2019, the global medical device giant Medtronic launched the Hugo RAS system and stepped up its global deployment. The Hugo RAS system was once considered the "most dangerous" competitor of Intuitive Surgical.

The approval of the Canadian Health Department this time undoubtedly escalated the "war" in the competition with the Intuitive Surgical surgical robot market. The Hugo RAS system currently only has two fields of urology and gynecological surgery. In the future, it is expected to successfully grab 54% of the 10 markets. The abdomen, colorectal and other fields will also apply for certification.

"Minimally invasive technology plays an important role in solving the backlog of surgical operations in Canada. It can help us optimize our valuable medical human resources when patients spend less time in and out of the hospital," said Neil Fraser, president of Medtronic Canada. "Today in Canada, only 1-2% of operations are performed by robots. I am proud that the introduction of the Hugo system means that we can help change this situation and, more importantly, help improve patients and medical service providers Experience. Our first step will be to work with hospital partners to determine the best candidate for RAS based on the patient’s prognosis and cost."

The United States is the world’s largest surgical robot market. Da Vinci robots have installed 3581 units in the United States. Medtronic has not yet disclosed the time point for seeking FDA approval in the United States. ), a key US EXPAND Uro trial is being established, which will use the Hugo RAS system to treat US patients for the first time. If everything goes according to plan, the system will be available in the United States in the next two years.

02 "Encircle and suppress" Leonardo da Vinci, domestically produced MicroPort acts as a pioneer

With the advantages of precise positioning of surgical robots, stability, and fewer complications, the global surgical robot market is showing a rapid growth trend. According to the Frost & Sullivan Report, the global surgical robot market will increase from USD 3 billion in 2015 to 2020. 8.3 billion U.S. dollars in the year, and may reach 33.6 billion U.S. dollars in 2026. The global surgical robot market is sorted by market size, and can be divided into five major markets: laparoscopy, orthopedics, pan-vascular, translucent, and other surgical robots. Laparoscopy is the largest market in this field.

In the past 20 years, Da Vinci has relied on patent protection barriers to firmly dominate the surgical robot market. With the expiration of patent authorizations, long-awaited competitors have quietly exerted their efforts. In the "encirclement and suppression" Da Vinci, in addition to Medtronic, veteran machinery companies and rising rookies in the industry have joined the track.

In November 2020, Johnson & Johnson launched the Ottava surgical robot system. The Ottava will be verified and validated in 2021, and it is expected to enter clinical trials in 2022. At the end of June this year, the surgical robot CMR Surgical began to expand rapidly after completing a $600 million round of financing to promote the global commercialization of the company’s flagship product Versius, which is an auxiliary robot designed to help minimally invasive keyhole surgery. , Is now used by health systems in Europe, Australia, India and the Middle East.

In China, after Xinjunte, Shurui, Jingfeng Medical, Changmugu, Yuanhua Intelligent, Ruilongnuo, Jianjia Robot and other companies that have received a new round of financing this year, the Hong Kong Stock Exchange also ushered in on November 2. The first surgical robot company: minimally invasive medical robots.

In China, Minimally Invasive is an enterprise that entered the surgical robotics track earlier, and is the only surgical robot company in the world that covers the five “golden tracks” of endoscopy, orthopedics, pan-vascular, transnatural cavity and percutaneous puncture. , Its product portfolio includes one approved product and eight pipeline products. The company’s three flagship products Toumai® Toumai® endoscopic surgical robot, Dragonfly Eye® DFVision® three-dimensional electronic laparoscopic endoscopy and Honghu® orthopedic surgery navigation positioning system have all entered the State Drug Administration’s special approval procedure for innovative medical devices (" Green Channel”), and Dragonfly Eye® was approved by the State Food and Drug Administration in June 2021.

In terms of sales price, Da Vinci is expensive in China, and a Da Vinci surgical robot equipment costs more than 20 million yuan, and it also needs to pay high maintenance fees and consumable replacement fees every year. Although the current price of minimally invasive medical robots is undecided, the price advantage of domestic products is obvious, which gives them the opportunity to substitute domestically. Executives of Minimally Invasive Medical Robotics said that in the next two years, they could be comparable to Da Vinci in terms of procurement and installed units. It is conservatively estimated that the volume of operations can catch up with Da Vinci in three to four years.

As of the end of 2020, apart from 3581 DaVinci robots installed in the United States, 800 units in Asia, the installed capacity of DaVinci robots in China exceeded 200, which still has huge room for increase in the domestic surgical robot market. At the beginning of the year, Shurui completed Asia's first pure single-port robotic radical prostatectomy and partial nephrectomy for renal cancer. Coincidentally, the Hugo RAS robotic prostatectomy, which Medtronic spent hundreds of millions of dollars and 10 years to build, was completed in Santiago, Chile in June this year.

Recently, Shurui surgical robots announced the completion of the exclusive round B+ strategic financing from Medtronic, the world's leading medical device company. Shurui's deep understanding of endoscopic surgical robots, deep mastery of advanced technology, and original high efficiency have become a move that impresses Medtronic. Important factor. Therefore, Medtronic brings a leading energy equipment and digital medical technology platform, coupled with a global sales channel network, will help the domestic surgical robot market to a higher level.

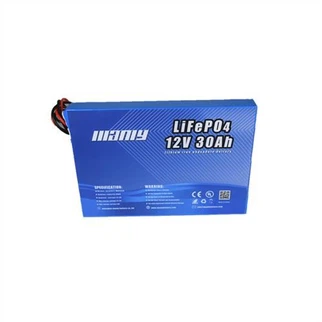

About Manly

More than 12 years of experience in producing lithium battery cells and battery packs for various applications. Welcome to send your requiry to info@manlybattery.com